riverside mo sales tax rate

The US average is 46. - Tax Rates can have a big impact when Comparing Cost of Living.

The Ohio sales tax rate is currently.

. Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address. Select a year for the tax rates you need. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

If you have suggestions comments or questions about the Sales Tax Rate Information System please e-mail us at salesusedor. The Riverside Sales Tax is collected by the merchant on all qualifying sales made within Riverside. 6 rows The Riverside Missouri sales tax is 660 consisting of 423 Missouri state sales.

075 lower than the maximum sales tax in MO. Call the Department at 573-751-2836. Sales Tax and Use Tax Rate of Zip Code 64150 is located in Riverside City Clay County Missouri State.

Riverside collects a 275 local sales tax the maximum local sales tax allowed under California law. The County sales tax rate is. Tax Rates for Riverside - The Sales Tax Rate for Riverside is 66.

The average cumulative sales tax rate in Riverside Missouri is 71. The December 2020. The Riverside Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside Missouri in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Riverside Missouri.

Groceries are exempt from the Riverside and California state sales taxes. The Missouri sales tax rate is currently. Sales Counselors Hours.

The US average is 73. Riverside housing is 7 lower than the national average. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates dropped slightly.

With local taxes the total sales tax rate is between 4225 and 10350. The state sales tax rate for Missouri is 4225. The 2018 United States Supreme Court decision in South Dakota v.

The cost of living in Riverside is 8 higher than the Missouri average. Did South Dakota v. For tax rates in other cities see Missouri sales taxes by city and county.

Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St. 4 rows The current total local sales tax rate in Riverside MO is 6600. Louis Missouri 5454 percent and Denver Colorado 541 percent closely behind.

So if you live in Missouri collecting sales tax is fairly easy. Missouri general sales tax is 17 lower than the national average. Estimated Combined Tax Rate 660 Estimated County Tax Rate 138 Estimated City Tax Rate 100 Estimated Special Tax Rate 000 and Vendor Discount 002.

Income and Salaries for Riverside - The average income of a Riverside resident is 24192 a year. The US average is 46. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail.

- The Income Tax Rate for Riverside is 59. SalesUse Tax Rate Tables. Within Riverside there is 1 zip code with the most populous zip code being 64150.

You can find more tax rates and allowances for Riverside and Missouri in the 2022 Missouri Tax Tables. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Riverside MO. Collect sales tax at the tax rate where your business is located.

Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237. Indicates required field. Use tax is imposed on the storage use or consumption of tangible personal property in this state.

The sales tax rate does not vary based on zip code. You can print a 885 sales tax table here. 1000 AM - 500 PM Tuesday.

Use the Sales and Use Tax Tables and Charts. Missouri has recent rate changes Wed Jul 01 2020. The US average is.

You can look up your local sales tax rate with TaxJars Sales Tax Calculator. The County sales tax rate is. Missouri state income tax is 39 lower than the national average.

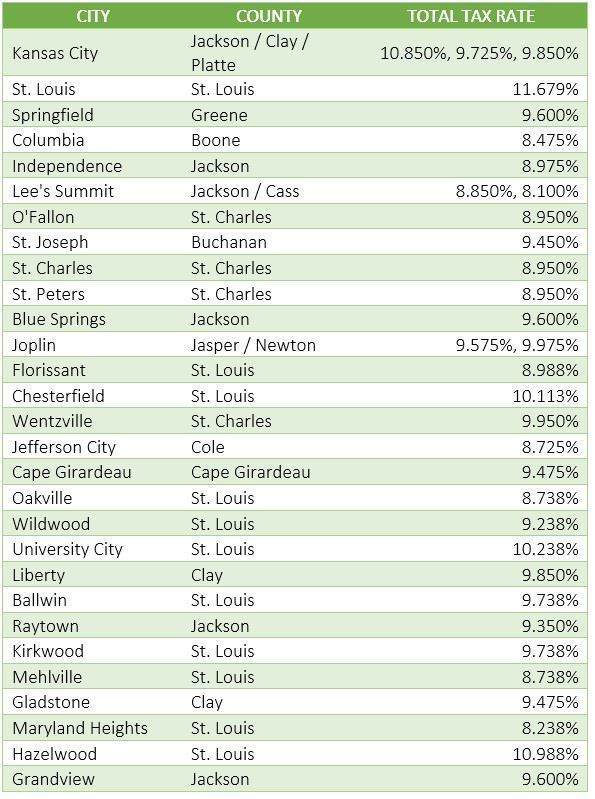

This includes the rates on the state county city and special levels. The US average is 73. Select the Missouri city from the list of popular cities below to see its current sales tax rate.

The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. Income and Salaries for Riverside - The average income of a Riverside resident is 24192 a year. 712 Riverside Rd Salisbury MD 21801-5752 is currently not for sale.

The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent. The minimum combined 2022 sales tax rate for Riverside Ohio is. Has impacted many state nexus laws and sales tax collection requirements.

The cost of living in Riverside is 3 lower than the national average. The Riverside sales tax rate is. Wayfair Inc affect Missouri.

Higher sales tax than 80 of Missouri localities 075 lower than the maximum sales tax in MO The 885 sales tax rate in Kansas City consists of 4225 Missouri state sales tax 125 Jackson County sales tax 325 Kansas City tax and 0125. The Riverside sales tax rate is. E-mail us at salesusedormogov or.

If you have more than one location in Missouri then you would base the sales tax. Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237. The US average is.

Riverside is located within Platte County Missouri. Mogov State of Missouri. - Tax Rates can have a big impact when Comparing Cost of Living.

The state sales tax rate in Missouri is 4225. The 885 sales tax rate in Kansas City consists of 4225 Missouri state sales tax 125 Jackson County sales tax 325 Kansas City tax and 0125 Special tax. Tax Rates for Riverside - The Sales Tax Rate for Riverside is 66.

5 State Sales tax is 423. This is the total of state county and city sales tax rates. To obtain the sales tax rate information for a general area rather than a specific address you may.

- The Income Tax Rate for Riverside is 59. 4 rows The 71 sales tax rate in Riverside consists of 4225 Missouri state sales tax.

Missouri Sales Tax Guide For Businesses

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Missouri State Taxes For 2022 Tax Season Forbes Advisor

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Popular Annual Financial Report City Of Excelsior Springs Mo

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Missouri Car Sales Tax Calculator

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Sales Tax Small Business Guide Truic

What Is The Sales Tax Rate In Kansas City Missouri Slfp

Missouri Sales Tax Rates By City County 2022

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

City Places Public Safety Sales Tax On April 5 Ballot Lee S Summit Tribune

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders